This was genius!

Two Black bankers merged their companies to create the largest Black-Owned bank in the nation with more than $1 billion combined assets.

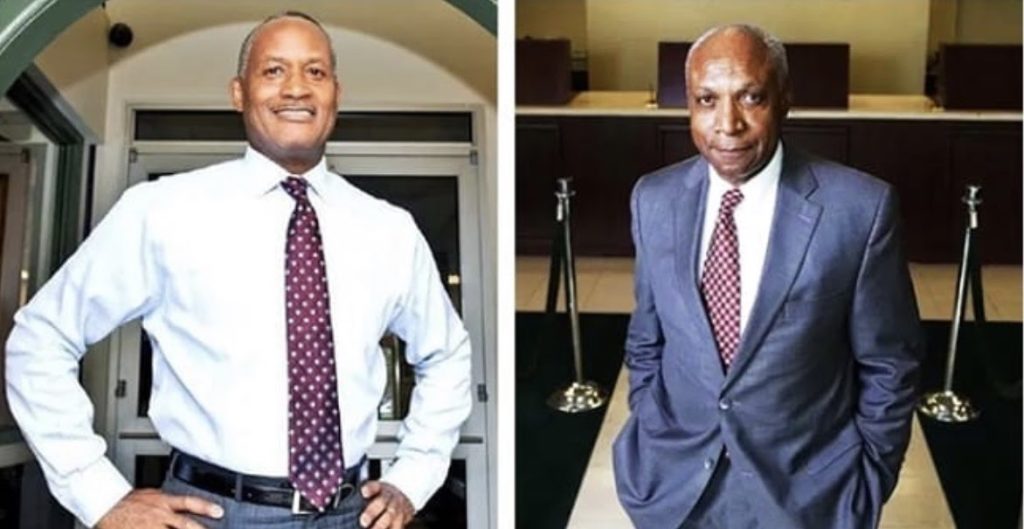

According to The Texas Black Business Directory, Brian E. Argrett, CEO of City First Bank in Washington, D.C. and Wayne-Kent A. Bradshaw, CEO of the publicly traded Broadway Financial Corp (BYFC), in Los Angeles, have merged to create a new company.

Under the new merger, Argrett will act as CEO with Bradshaw serving as chairman, combining to increase their lending capacity for commercial investments with a focus on affordable housing, small businesses, and nonprofit development in underserved areas.

“We need to scale up our impact,” Argrett said in a New York Times interview. “Having a larger capital base is important so we can direct more resources into underserved communities.”

Both City First and BYFC have maintained impeccable financial status as Community Development Financial Institutions (CDFI) with a long history of advancing economic and social equity in moderate and low-income communities. The duo also plans to use its new status to create a national platform for other investors looking to make an impact in the community.

In the midst of a global pandemic, unprecedented unemployment and the very important social unrest going on in our country, C.D.F.I.s are the answer,” Argrett said. “By building a bicoastal and national platform, we have the opportunity to become a very attractive platform for impact investors looking to join this space.”

In the United States, there are 143 Minority Depository Institutions, but just 20 are Black-led according to the government’s latest data. A recent study by the Federal Deposit Insurance Corporation found that such minority-led institutions outperformed traditional banks in originating mortgages and federally backed small-business loans to borrowers in low- and moderate-income census tracts, the New York Times reports.

The new institution will maintain its CDFI status, operating bi-coastally while still serving its current areas, with the hope of expanding to new potential markets in the near future. As a national bank, they will continue to operate supervised by the Office of the Comptroller of the Currency (OCC) and be listed on the Nasdaq Capital Market.

The transaction, which is expected to close early next year, will leave Broadway stockholders with 52.5 percent ownership of the new company and City First shareholders with 47.5 percent ownership.

Congratulations fellas!

Photo Courtesy of The Texas Black Business Directory